Axovant Sciences (NASDAQ: AXON) just raised $315 million by offering 21 million shares at $15. The stock closed at $29.90, which valued the company at $2.8 billion. In my opinion, the company doesn't seem worth the investment. The craziness in the market reflects that we are really in a biotech bubble.

Axovant was created by Vivek Ramaswamy, a 29-year-old former hedge fund manager. He is also the chairman of Tekmira Pharmaceuticals (NASDAQ: TKMR). In December 2014, Ramaswamy picked up an abandoned Alzheimer's drug called SB742457 (now known as RVT-101) from GlaxoSmithKline for €4.5 million. This is Axovant's sole asset.

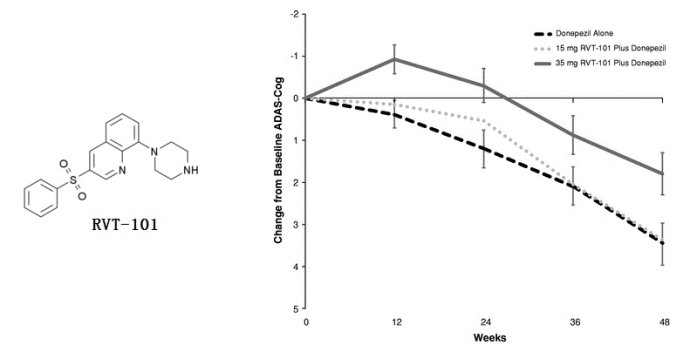

RVT-101 is a selective 5-HT6 receptor antagonist and has been evaluated in 13 clinical trials. RVT-101 alone is ineffective when compared to placebo. But RVT-101 plus donepezil did demonstrate an improvement in cognition in the AZ3110866 trial (Phase IIb).

Both RVT-101 and donepezil don't treat the underlying cause of Alzheimer's disease. The benefit of RVT-101 in combination with donepezil was only 12 weeks compared to donepezil alone. There was good reason why GlaxoSmithKline gave up the compound.

Axovant isn't alone in this field. Lundbeck and Otsuka Pharmaceutical are testing a similar drug known as idalopirdine (Lu AE58054) in Phase III trials. In March 2013, Otsuka acquired the rights to idalopirdine in the U.S., Canada, and East Asia for $675 million.

Addition of idalopirdine (90 mg/day) to donepezil treatment resulted in improved cognitive performance as measured by ADAS-Cog at Week 24. Idalopirdine seemed to be more effective than RVT-101 (mean difference in ADAS-Cog: -2.16 vs. -1.66).

After the acquisition last December, Axovant didn't conduct any clinical trial at all. But Ramaswamy got two trump cards: (1) Lawrence Friedhoff, the developer of donepezil; (2) Lawrence Olanoff, the developer of memantine. Axovant intends to begin a Phase III pivotal trial in 2015Q4 and to submit an NDA to the FDA by the end of 2017.

Two other hedge funds, RA Capital Management and Visium Asset Management indicated an interest in purchasing up to $150 million of Axovant shares at the IPO price. However, they are allowed to sell their shares (if they buy) after 90 days, half the standard lock-up time.